Whether it's love from family abroad or payment for your work

Money from around the world, ready for you in Naira on your terms

The Crossboda Advantage

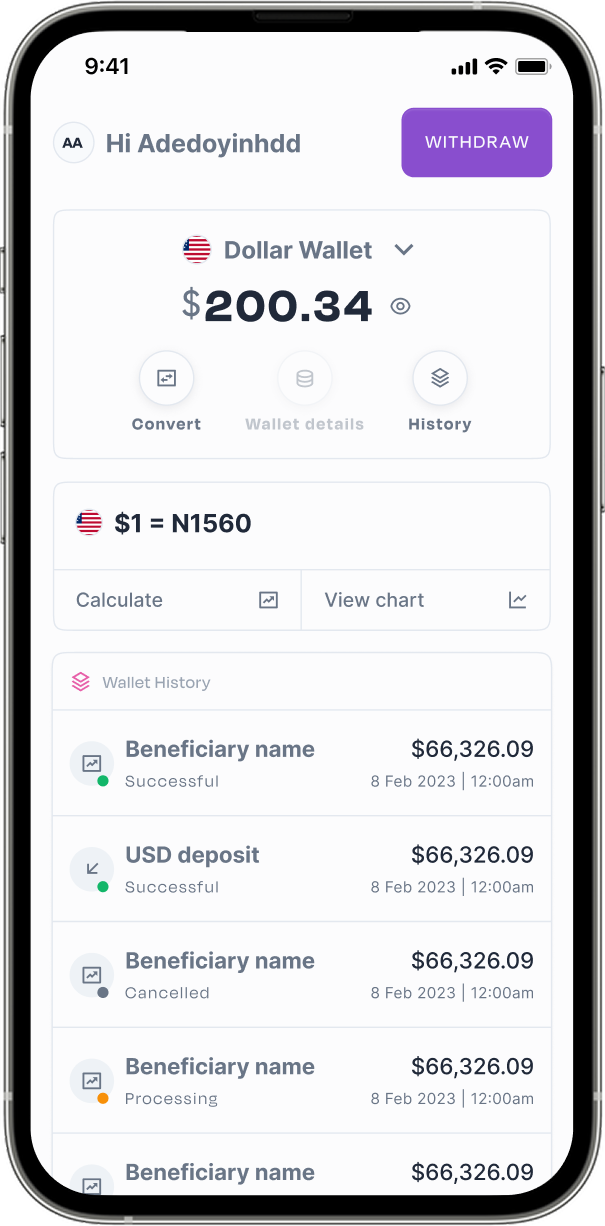

Simply send your account details, and funds from clients, friends, or platforms abroad land securely in your account.

One Tap,

Global Reach

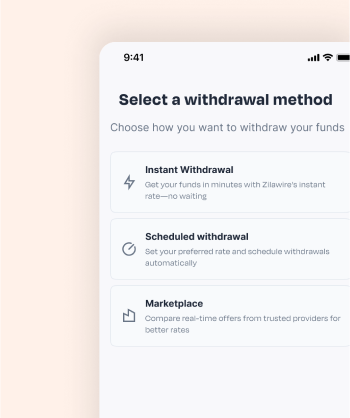

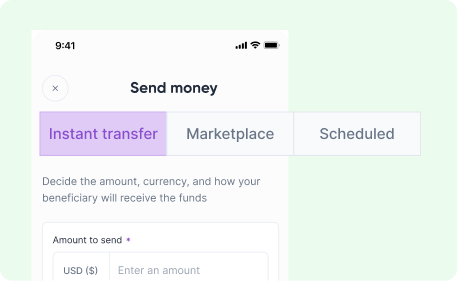

Access your funds any way you choose: Instant withdrawals, scheduled payouts, or through our marketplace. Crossboda puts you in control.

Your Money,

Your Rate

Receive funds globally, convert when ready, and withdraw however suits you. With Crossboda, you have full control and visibility over your money at every step

Global In. Local Out.

Your Way

Crossboda is regulated by

regulated as a Canadian Money Services Business (MSB) by FINTRAC

Licensed by the CBN as an IMTO (International Money Transfer Operator)

How we get things done

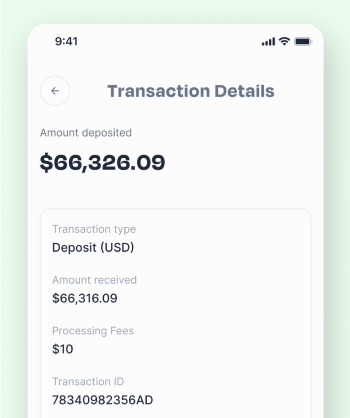

Full Transparency, No Hidden Charges

Simply send your account details, and funds from clients, friends, or platforms abroad land securely in your account.

Lightning-Fast

Transfers

In a twinkle of an eye, your money moves. We don’t keep you waiting. Speed is our default setting, no delays, no waiting.

Trusted, Regulated, and Reliable

We’re a FINTRAC-registered Canadian MSB — so your money moves through a system that meets top compliance and reliability standards

Create & Verify Your Account

Sign up in minutes and complete a quick verification to activate your wallet

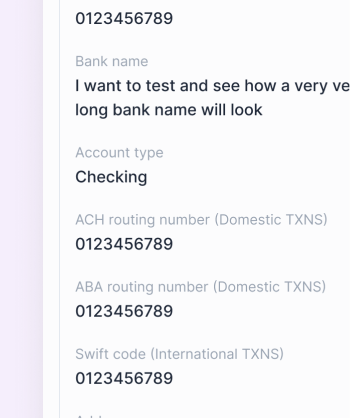

Share Your Wallet Details

Get foreign account details you can send to clients, friends, or platforms to receive money

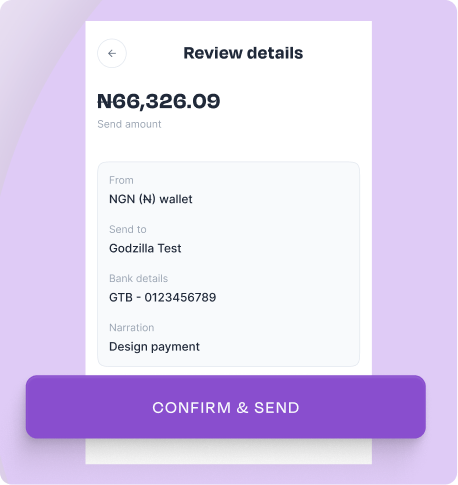

Convert & Withdraw in Naira

Convert, or withdraw your funds when it works best for you — instantly and securely

Chiboy Chibueze

Just a dominating statement from the videos.

Crossboda app, the best app to ever do this crossborder thing. So easy and so seamless

Got questions?

We’ve got answers.

Find quick answers to the most common questions people ask about using CrossBoda

Is there a limit to how much I can receive at once?

Yes. To comply with international regulations and keep transfers secure, there are limits on how much you can receive from each sender:

Daily limit: $1,000 per sender

Monthly limit: $5,000 per sender

If a sender tries to send more than these limits, additional documentation may be required before the funds can be released

How long does it take for money to arrive in my Crossboda wallet?

Timing is determined by the sender’s bank and payment method, not Crossboda. Once funds arrive, they reflect instantly in your wallet.If sent via local payment methods like FedWire, US ACH, UK Faster Payments, EU SEPA, funds typically arrive within 24 hours.If sent using SWIFT, it can take 2-3 business days.

Which countries can I receive money from?

Right now, you can receive USD payments from most countries, including the US, UK, and others. We’re working on adding support for GBP, EUR, and more currencies soon.

Are there withdrawal fees?

No, Crossboda does not charge any fees for withdrawals. You can withdraw your converted naira funds to your local bank account without any extra cost.

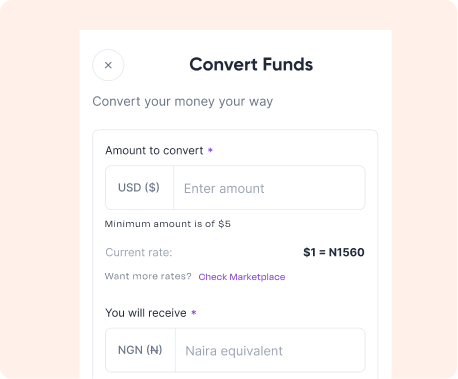

Do you offer real-time exchange rates?

Yes, we show live market-driven rates so you can convert at the best possible time. You can also set a target rate and schedule your conversion to trigger automatically when that rate is met. Plus, you can explore favourable rates from other users in our marketplace.

Can I cancel a withdrawal after initiating it?

Withdrawals are processed quickly, so once a real-time withdrawal is initiated, it cannot be cancelled. Please double-check the amount and destination account before confirming.However, for scheduled withdrawals, you can cancel anytime before your target rate is hit. If the rate isn’t met within 72 hours, the scheduled withdrawal will be automatically cancelled.

Whether it’s family support or business back home

Support loved ones or fuel your hustle back home with simple, flexible transfers.

The Crossboda Advantage

Faster Transfers,

No Hassle

Your money gets to your loved ones or business partners quickly, without unnecessary delays

Dedicated Support,

When You Need It

You're never alone with Crossboda. Our support team is ready to assist you, ensuring smooth transactions and quick resolutions.

Convert at the Best Rates

Get more value on every transaction with competitive FX conversions

Local or Foreign,

We’ve Got You

Whether it’s naira to a local bank or FX to a domiciliary account, your choice, your control.

Send Money Your Way

Get more value on every transaction with competitive FX conversions

Secure & Regulated Transfers

Transparent, secure, and protected at every step, your transactions meet the highest standards of safety and reliability

Crossboda is regulated by

regulated as a Canadian Money Services Business (MSB) by FINTRAC

Licensed by the CBN as an IMTO (International Money Transfer Operator)

Create & Verify Your Account

Sign up in minutes and complete a quick verification to activate your wallet

Enter Your Recipient's Details

Provide the bank or domiciliary account information for who you’re sending to

Send & We Deliver to Them in Naira

Fast, secure, and reliable delivery in naira or foreign currency to any Nigerian bank account or domiciliary account

Chiboy Chibueze

Just a dominating statement from the videos.

Crossboda app, the best app to ever do this crossborder thing. So easy and so seamless

Got questions?

We’ve got answers.

Find quick answers to the most common questions people ask about using CrossBoda

Is there a limit to how much I can send at once?

There is no fixed limit on how much you can send through Crossboda. However, the funds you use must come directly from your personal account or card, not from a third party. This ensures your transfers meet compliance and security requirements

How fast does the recipient get the money?

Most transfers to Nigeria are delivered within minutes. In some cases, depending on standard security checks, it may take up to 24 hours for the funds to reach the recipient’s bank account

How much does it cost to send money to Nigeria with Crossboda?

When you send Naira (to a local Naira bank account), the transfer is completely free, no fees at all.If you choose to send Dollars (to a domiciliary account where the recipient receives USD), a small flat fee of $20 will apply

Can I send money for business or just personal use?

You can send for both personal remittances (family/friends) and business/service payments

What information do I need from my recipient in Nigeria?

To send money to Nigeria, you’ll need your recipient’s:

1. Full name (as it appears on their bank account)

2. Bank name

3. Bank account number

4. Account type (Naira account or domiciliary account, if you’re sending USD)

Do you offer real-time exchange rates?

Yes, with Crossboda you always see live, market-driven exchange rates, so you can send money when it makes the most sense for you. You can also set a target rate and let your transfer go through automatically once that rate is reached. And if you want even more value, you can explore better rates offered by other users in our marketplace